3 Yield Farming Strategies for DeFi Beginners

A Practical Guide to Maximizing Returns While Minimizing Risk

3 Yield Farming Strategies for DeFi BeginnersA Practical Guide to Maximizing Returns While Minimizing Risk

As of 2025, decentralized finance (DeFi) has moved beyond being a trend and is now a key part of many investors’ passive income crypto strategies. Among the available DeFi tools, yield farming—earning rewards by providing liquidity or staking assets in smart contracts—is considered a relatively accessible approach even for newcomers. However, chasing high returns without a clear understanding can expose beginners to serious risk.

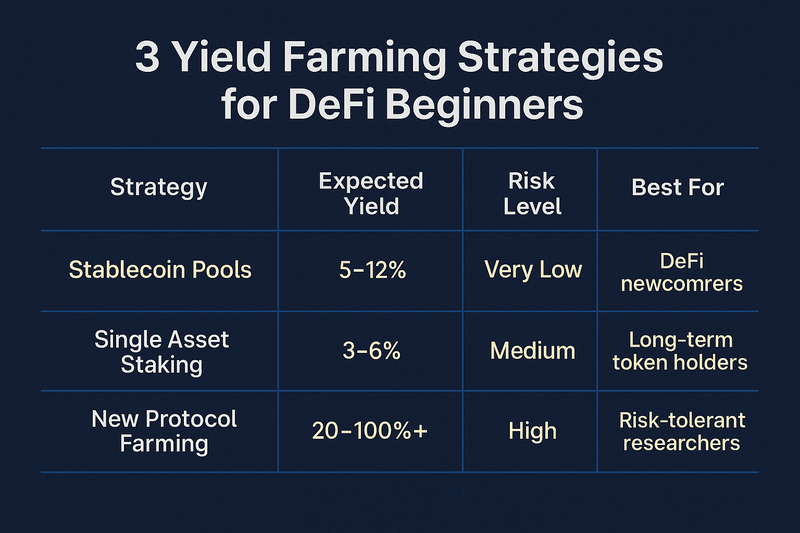

This article outlines three essential DeFi yield farming strategies for beginners that balance profitability with risk control.

1. Stablecoin Pools: Low-Risk Entry Point For those just entering the DeFi space, one of the safest starting points is to provide liquidity using stablecoin pairs such as USDC, USDT, or DAI. Platforms like Curve, Aave, and Spark Protocol offer annual percentage returns (APR) ranging from 5% to 12%.

The main advantage here is minimal impermanent loss since the value of stablecoins rarely fluctuates dramatically. This makes it an ideal entry strategy for understanding the DeFi ecosystem without facing major capital risk.

The downside is relatively modest returns compared to riskier strategies. Still, from a capital preservation standpoint, this is the most prudent path to begin with.

2. Single Asset Staking: Simple and Secure If you already hold a specific crypto asset, staking that token directly within its native protocol can be an efficient way to generate passive yield. For example, Ethereum (ETH) holders can use platforms like Lido or Rocket Pool to earn 3.5–4.5% APR through liquid staking.

Similarly, Layer 1 tokens such as Solana (SOL), SUI, and Cosmos (ATOM) offer staking rewards within their respective ecosystems. Single-asset staking typically involves lower risk of impermanent loss and is a good fit for long-term holders of well-established assets.

Caution is still advised: if the token’s market value drops, the yield may not offset the capital loss.

3. Early Liquidity Incentives: High Risk, High Reward Another strategy involves targeting newly launched DeFi protocols that offer high-yield liquidity incentives to attract users. For instance, LayerZero-based platforms have offered launch-week APRs exceeding 100%.

This approach requires active research and timing. You’ll need to monitor crypto Twitter, Discord groups, and launch calendars for “early farming opportunities.” Always verify smart contract addresses to avoid fraudulent schemes. While the rewards can be significant, the risks—including rug pulls and contract exploits—are equally high. It’s generally wise to wait a few days post-launch to assess liquidity trends before jumping in.

■Conclusion DeFi yield farming is more than just depositing tokens—it requires understanding protocol mechanics, reward structures, and associated risks. For beginners, the golden rule is simple: start small, use well-audited platforms, and favor simplicity over complexity.

Chasing high APRs without understanding the underlying risks can lead to long-term losses. Always account for smart contract vulnerabilities, token price volatility, and liquidity risk.

If you're new to DeFi, consider testing these strategies with small amounts. As the DeFi ecosystem continues to evolve, one principle remains constant: returns only matter when risk is properly managed.

<저작권자 ⓒ 코인리더스 무단전재 및 재배포 금지>

|

많이 본 기사

Insight 많이 본 기사

|